Good News for all Pakistani Nationality Holders who have the potential to establish their own businesses. Recently, Prime Minister Imran Khan launched a new Scheme named it Bila Sood Qarza Scheme/Loan Scheme. It’s the best chance to establish their own business for those who aged between 21 to 45 years. Additionally, those who desire to start IT/E-Commerce-related businesses can also get loans, and the age limit for those is 18 Years.

Bila Sood Qarza Scheme 2024

Bila Sood Qarza Scheme 2024

So, if you’re looking at the guidelines about PM Bila Sood Qarza Scheme/Loan Scheme, then you’re going to like this post. That’s because we’ve mentioned here all the relevant details about PM Loan Scheme such as registration procedure, eligibility, security, etc. Let’s get started! The Prime Minister of Pakistan has introduced an interest-free loan scheme for youth. Citizens of Pakistan can apply online for Prime Minister Loan scheme 2024.

Prime Minister Youth Loan Scheme 2021

Youth Entrepreneurship Scheme is for startup businesses and also expands your already existing business. So, to learn more about loan schemes read the entire article carefully. Prime Minister Imran Khan has launched the Kamyab Jawan National Youth Development Scheme. Bila Sood Qarza Scheme is very helpful for youth to start their business.

Kamyab Jawan Program Loan NBP application form

All loan takers can fix their installments long-term and short-term. Banks offer flexible installment plans for the beneficiaries of the Kamyab Jawan Loan scheme 2024. Candidates can take the interest-free loan for new businesses and also continue the business. However, applicants will have to provide security for one govt employee. Basically, the Kamyab Jawan loan scheme is Qarz-e-Hasana for our young nationals.

Prime Minister Loan Scheme 2024 Online apply

In this scheme, Pakistani Youth can get Interest Free Loan for their new business or existing business across Pakistan. According to the State Bank of Pakistan SBP, Loan Application Forms are available in three Branches which are mentioned below. Multiple Pakistan nominated banks to offer interest-free loans to youth under the PM loan scheme.

- National Bank of Pakistan

- Bank of Punjab

- Bank of Khyber

Prime Minister Bila Sood Qarza Scheme

Pakistanis aged 21 to 45 years can qualify for Bila Sood Qarza/PM interest-free loan scheme. People who target to start IT/E-commerce businesses can apply for this scheme at the age of 18 years. In addition, PM’s special advisor of youth affairs Usman Dar has the initiative to increase the loan budget in upcoming years.

PM Bila Sood Qarza Scheme 2024

They can apply online via the nominated bank’s official website for Prime Minister Loan scheme 2024. Interested People can download the Kamyab Jawan Application form above mentioned Bank Official website or here are forms also available at the end of the page. Now Students and Youth can get benefit from this scheme within dates.

www.kamyab jawan.gov.pk phase 2

The Prime Minister’s loan scheme is functional till now. In this article, we are discussing complete information on the Kamyab Jawan Interest-free loan scheme 2024. Many young in Pakistan has the vision to start their business but they lack investment/capital. Now the government is going to provide interest-free loans in essay installments to such young ones.

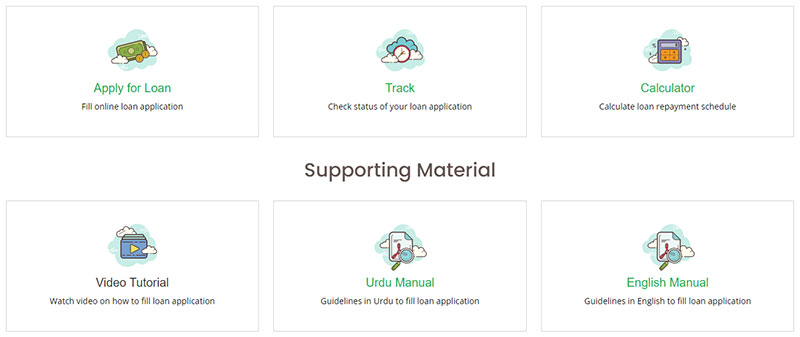

Fill online loan application, for bila sood qarza | Check the status of your loan application | Calculate loan repayment schedule |

Prime Minister Interest-Free Loan Scheme 2024

First time in history Pakistan is helping young nationals financially. The present govt has understood the talent and abilities of Pakistani youth. That’s why it has started the largest interest-free loan scheme. Govt has launched a portal at kamyabjawan.gov.pk for the complete guidance of this program. Kamyab Jawan loan program is for both males & females. NBP has reserved a 25% loan for women.

Kamyab Jawan program.gov.pk Online Registration

Before jumping into the Online Registration form read the loan payment details; there’re three categories of providing loans in the Bila Sood Qarza Scheme which is below;

- 3% markup on the range of 100,000 to 1 million PKR.

- 4% markup in the range of 1 Million to 10 Million PKR.

- 5% markup on the range of up to 25 Million PKR.

PM Kamyab Jawan Program 2024 Form Youth Loan Scheme

These loans will be given on the basis of money and the duration will be 8 Years. The procedure of your application will be done in 15 Days. In order to apply for Prime Minister Youth Loan Scheme then read the given below article. The government of Pakistan has opened the second phase of the Kamyab Jawan Loan scheme 2024. There are no hard and fast rules to apply for www.kamyabjwan.gov.pk phase 2.

Prime Minister’s Kamyab Jawan Scheme

Government employees cannot apply for Prime Minister Bila Sood Qarza’s scheme 2024. Designated bank branches will verify your application before providing the loan. PM loan scheme 2024 registration is open for interested individuals. They can physically visit the National Bank of Pakistan, Bank of Punjab, and Bank of Khyber.

Prime Minister Loan Scheme 2021 Online Apply

If you’ve planned to get Prime Minister Loan, then read the complete procedure for applying online here. Basic details about Prime Minister Loan Scheme are mentioned above. To make easier registration process we’re given steps below follow these steps to submit your application properly;

Caution: Recently, PM Loan Application Form has been refurbished. Fill inconsistency all details, press the save button, and at the end click the completed application save button. If you will not fill out properly application form then your application will not be forward for the next procedure; don’t rush!

- Go to the official website of Kamyab Jawan Program URL @https://kamyabjawan.gov.pk/.

- Then provide CNIC Number and CNIC Issue Date*in the boxes;

After filling properly the CNIC Number and CNIC Issue then click the search button. After a few seconds, You’ll be shown a new window about your status.

Bila Sood Qarza Scheme 2024

Bila Sood Qarza Scheme 2024